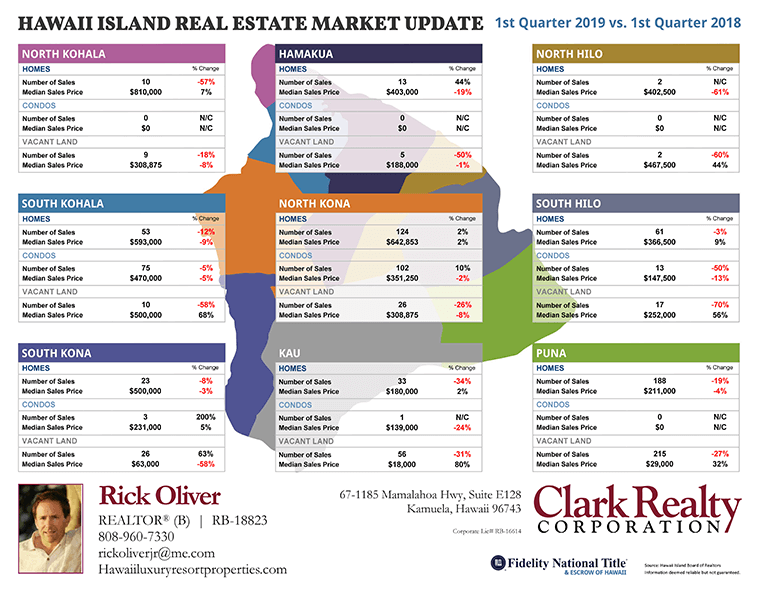

First Quarter 2019 Sales statistics

Sales statistics for the first quarter of 2019 reveal a relatively “flat” market compared to this same period in 2018 for the South Kohala area. Condominium unit volume is down 5% in South Kohala where most sales are condominiums centered within the 3 major resorts with the majority of transactions occurring in the Waikoloa Village and Waikoloa Beach Resort. You can deduce the area where these sales are occurring using the average sales price of $470k as your guide. There are no condominiums for sale in the South Kohala area for sale except in the Waikoloa Village and Waikoloa Beach Resort in this general price range.

The number of home sales in South Kohala are also down YOY. This could be because of a lack of inventory. Using the average sales price of $593,000 you can also pin point the majority of transactions occurring in Waikoloa Village. Homes have appreciated faster than condominiums in the post recession years between 2012 – present so it could be it’s time for condominiums to catch up. The last time the average sales price of a home reached near $600k was in 2006 just prior to the peak. Resort condominiums are still selling for between 10-30% less than 2006 peak prices depending on the resort community.

As an example, my neighbor’s Lehua plan in The Villages at Mauna Lani is for sale with a list price of $899k. I was the listing agent when it last re-sold for $1.25m in 2006. It sold to the original owner in 2003 for $775k. I believe there is still a lot of value in condominiums, land and single family homes located in the resorts. Less “value” can be found in single family homes outside of the resorts in the $500k-$800k where prices exceed the 2006 peak and inventories are low.

Follow the link to a good article in the West Hawaii Today that includes comments from several well known and respected economists. Here is the leading quote regarding the Big Island’s general economic state that involves residential real estate:

“Boring can be good. And the next couple of years look exactly that — calm and dull. Say goodbye to those wild spikes in the housing market that the country has grown used to. In 2019 and 2020, the economic outlook around the national scene is expected to grow at a snail’s pace. Home sales should inch up 2 percent by 2020, home prices by around 3.6 percent. The Gross Domestic Product, meanwhile, should plod upward at around 2 percent.”

“Valuations (on the Bg Island) can be expected to rise at a 2.4 percent clip. But Hawaii should keep its eyes on other factors. It’s GDP is increasing at 1.8 percent, less than the nations, and migration out of the state continues to be a factor.”

Please let me know if you have questions regarding your particular community. Every “market” is different even within the same general area or resort.