COVID-19 Affects on Hawaii Real Estate

I thought it would be helpful to write a blog post on my observations during the beginning of the Virus outbreak and its current effect on resort sales and listings. I’ve included slides from a webinar I watched from CORELOGIC, Strategic Agility in Uncertain Times: Real Estate & Rental. CORELOGIC has a world-class economic forecasting team with commentary on various slides presented. CORELOGIC has access to most MLS systems within the US and Canada, where they can peer into real-time happenings in many markets, including our own in Hawaii, which is insightful. Here is a link to the Webinar:

https://corelogic.zoom.us/webinar/register/2015873986761/WN_XWB88BbURteTZt7j3E5NWQ

My own experiences have been positive regarding listing and selling real estate so far. I have a Canadian buyer client that negotiated a contract during the last few weeks of February to purchase a Mauna Lani condominium. As the news got worse regarding travel bans from China and Europe, the contract negotiations became easier until we were able to agree.

On the listing side, I have a client that decided to list their property, knowing the State lock-down includes new visitors; therefore, potential buyers. I advised him that I felt it was an excellent time to market his property as there are plenty of eyes on computers, and a slow down in listing activity makes their property stand out against some older listings. Sure enough, we received a low offer within days of placing the property on MLS, demonstrating at least one buyer was waiting for a new offering, but expecting a significant discount. I have had 4 “virtual” or live buyer showings in the last two weeks on this same listing.

In my community, I just observed a Villages at Mauna Lani Lehua model go into escrow in 34 days. These plans are sought-after, and I have the feeling it will close near the list price sooner than later. There are plenty of other properties closing and or going into escrow currently in all resorts.

Market Observations

Buyer Attitudes:

I believe prospective buyers within this “COVID” environment could be expecting a 10-15%+ discount on current values (not listing prices). I predict this attitude will persist until the last quarter of 2020 when we will understand the final development and implementation of a vaccine program which will prevent the virus. I believe in most cases, they will be unsuccessful in negotiating this deep of a discount.

Seller’s Attitudes:

Most sellers in this market purchased at low prices post the 2009 recession. Therefore the average owner’s current value may include 10%+ in appreciation. This appreciation makes these owners less susceptible to foreclosure or a distressed sale value as their value is not “underwater”. I predict most owners will not list their properties within this environment and choose instead to “hold,” instead of considering a discounted sales price even though they may not be receiving vacation rental revenue. I predict those that have properties listed will either pull the listings or continue to market, knowing they have one of the few properties for sale.

General observations and predictions:

Condominiums, with a list price under $1m, were already few relative to demand within the Resort markets until the end of February 2020. If future listing activity mimics the current trend on the Mainland, we will see a 50% drop in the coming months of all property listings for sale including those in the resorts as sellers are unwilling to take a +/- $50k-$100k “discount” and choose to “hold” their properties off the market and list in the last quarter of 2020 or first quarter 2021. The United States’ MLS statistics show Year over Year closings are down in February/March 20%, and pending sales are down 40%. The decline in closings indicates the number of buyers in escrow, ready to close in December or January, backed out and didn’t settle in February and March. The 40% decline in Pending Sales show the reduced number of buyers willing to go forward and close in the next few months. These events coincided when the Nation had the first death from the virus on February 29, therefore, the reduced closings and then March 13 when the President declared a national emergency because of the pandemic causing the reduced pending sales.

See the slide titled “Weekly MLS Contract Signings and Closings Drop.” See also the slide titled “Decrease in Weekly New Listings on MLS” April 2020.

Sales would follow at or near a 40% drop in volume year over year until the last quarter of 2020. With a “V” shaped recovery, values would return to 2nd quarter 2019 values or earlier in the first or second quarter of 2021, and the market should continue a positive path. See the slide titled, “V or U shaped recovery? IHS predicts V-Shaped Recession-Recovery IMF Predicts U Shaped.”

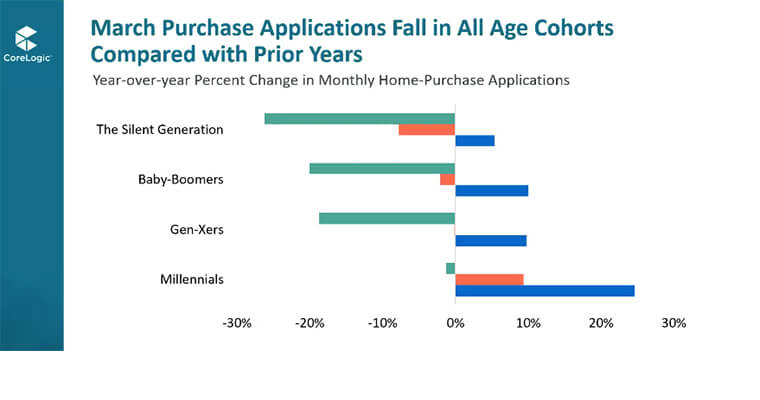

A Majority of resort buyers are either “Baby Boomers” or “The Silent Generation.”

The CORELOGIC presentation noted that the most significant pullback in mortgage applications is from 2 groups, Baby Boomers and The Silent Generation or those born between 1928-1960. These generations of buyers and sellers meet at least 60% of current resort owners I know, and my buyer clients who tend to be more conservative. Condominiums under $1m, are often mortgaged even though the buyers are capable of paying cash as interest rates are meager. Despite low-interest rates or the ability to pay cash, I believe this group will hold back from purchasing until some certainty regarding a vaccine is revealed for their personal safety until at least the 4th quarter of 2020. This group could also be more hesitant to travel to Hawaii to pursue a purchase for the same reason-exposure to the virus via air travel or airports.

See the slide titled, “March Purchase Applications Fall in All Age Cohorts Compared With Prior Years.”

More Air-Lift is needed from the Mainland, and International markets and termination of STVR prohibitions are key for Hawaii’s business recovery within the Resort Markets.

Even though Hawaii in general and Hawaii Island, in particular, have not necessarily been negatively effected, relative to virus infections, Hawaii’s political sentiment is overly cautious. This “cautious” sentiment will lead to a later than sooner opening of businesses, including travel-related companies, Hotels, restaurants, etc. Other factors, including reduced “Air-Lift” from the Mainland and international destinations, will negatively influence our hotels from re-opening. The prohibition on Short Term Vacation Rentals and renewals will need to be removed as this type of accommodation represents the majority of tourist’s choice. The County’s failure to do so despite the re-opening of most other States businesses will stall a Hawaii business recovery.

Those are my thoughts and prognostications even though any number of factors could affect the reality here on the Big Island. We hope and pray for the best, especially for those affected by the virus, as well as the many underemployed and unemployed, we count as friends and relatives. We know with proper leadership and our own positive reactions to these challenging times, we will thrive again very soon.

CORELOGIC Webinar

CORELOGIC Webinar-Strategic Agility in Uncertain Times: Real Estate & Rental.

Consolidated and edited comments by Dr. Frank Nothaft, Chief Economist, CORELOGIC from the audio feed.

Here is a link to the Webinar:

https://corelogic.zoom.us/webinar/register/2015873986761/WN_XWB88BbURteTZt7j3E5NWQ

Highlights:

Mortgage forbearance on Fannie and Freddie Mac mortgages

-Up to 180 days in duration with the possibility of an extension. No negative effects on credit rating. Must pay back forbearance. Evictions are delayed.

“V” or “U”? IHS: V-Shaped Recession-Recovery, IMF: U-Shaped

-Our vendor (IHS) is projecting a V-shaped recession and recovery. That means a real quick snap back in the economy with growth already in the fourth quarter of 2020 and then very strong growth in 2021 with 10% GDP growth in the economy in 2021. So that’s the “V” shaped recovery.

-To contrast this forecast we had from our vendor, the International Monetary Fund is forecasting, both for the USA and for Canada, a “U” shaped recovery where the recovery in 2021 is somewhat flat with growth starting in 4th quarter 2021 at a level less than 4th quarter 2019.

-IMF bases its opinion upon the availability of a Virus vaccine and the timeline of its development. Their opinion is that it will be available last quarter of 2021.

Long Term Mortgage Rates are Low

-Central Banks in the US and Canada have substantially increased liquidity and helped to push down mortgage interest rates. (by fueling the secondary mortgage purchase market).

-Mortgage rates are basically dirt cheap right nowhere in the US. We’ve hit a record low for a 30 year fixed-rate or 15-year mortgage. 30-year fixed-rate mortgages currently are about 3.3%, 15 years, fixed-rate mortgages about a half a percentage point lower, and the projection is that they’ll probably move gradually even lower in the second half of this year and bottom at around 3% for 30-year fixed-rate loans. Canadian rates should follow the same pattern.

A decrease in Weekly New Listings on MLS

-Some prospective buyers and some prospective sellers have the “science” of “pull back and not participate” right now because of their concerns over you know, the virus and perhaps being exposed to it so buyers and sellers have pulled back at the same time and inventory on the market for sale already was very, very low in January and February. Here in the US, what I’ve plotted in this chart is data that we have from the Corelogic MLS and it shows the numbers. I’ve highlighted a couple of dates here that are important here in the US, February 29, when we had the first death from the coronavirus here in the United States, and then March 13 when the President declared a national emergency because of the pandemic. And in particular, after that latter date, we saw a real change in the overall market as we began to see open houses canceled, and began to see a real drop off in the number of new listings. And as you know, this is the time of the market where we typically see a pickup for the spring home buying season. So typically, new listings and buyer demand or both rising as we get towards the end of March and into April, which was completely the opposite of what we would have expected back in February, and it’s completely opposite from what happened last year, all because of the pandemic. So weekly new listings are down almost 50% in the latest weekly data compared with a year ago. And the next slide, we can see what’s happened with pending sales contracts as well as closings very similar pattern.

Weekly MLS Contract Signings and Closing Drops

With closings and pending sales both down, closings down 20%, pending sales down 40% through the first week of April, compared to the same time last year, so buyers pull back purchases and sellers pull back listings, as well as the total number of sales as a consequence.

March Purchase Applications Fall Compared with Prior Years

-This chart reflects our loan application database. We have here Corelogic and the days presented the same way as in the prior charts that are by the week, year over year percent change from the prior year. And likewise, you know, January and February and started a year was looking pretty good. You know, home sales were up from a year ago. Home purchase loan applications were up from a year ago, but gosh, one of the differences in the last three, four weeks have made in the economy. The number of home purchase applications kind of mimics what we’re seeing in the drop off in pending sales from the MLS data and home purchase loan applications are down almost 30% in early April compared to last year.

March Purchase Applications Fall in All Age Cohorts Compared with Prior Years.

-What’s really interesting though McLaren, when I looked at the data, there were some really interesting differences from the age of the borrower by the cohort. When we look on the next slide, you can see what they are. We looked at the data by cohort and we compare the activity again year over year percent change for the month of January, February, and March and really interestingly, you know, January, February, pending sales, which pretty much determine home purchases (loan) applications were up from the year prior. Not surprising those become the March closings. Now purchase applications are down, but they’re down the most for older homebuyers but for millennials, they are down, but only a little bit for the Millennials cohort. Millennials, for the most part, they are transitioning from a rental into first-time homeownership and for those Millennials who have their jobs and have their financial house in order-Wow-they are looking at these record-low mortgage rates, and they say, we want to buy-we want to be in the market buying. So we haven’t seen really much of a decline in millennial applications in the month of March, where we saw a big drop is where the older homebuyers which are either trading up or downsizing. The older homebuyers and the ones that at least from the health reports are more at risk for contracting the COVID-19 virus, so not surprisingly they’ve really pulled back from the marketplace and really start really pulling back in terms of buying homes, but millennials appear to be reactive.