2018 Real Estate Market Update

I’m frequently asked my opinion of the current real estate market and usually answer back within my response several questions like, “which real estate market on the island would you like information” as all “markets are very particular to their location?” and or “how much time do you have to discuss this topic?”. We all have a good “rear view mirror” but most people do not have a “crystal ball” to develop future predictions especially for our micro market. Because of this and my love for facts and figures, I often read various publications regarding real estate in general and the Big Island in particular to be able to answer these inquiries. I often post these to Facebook-sign up here to Follow me. As us locals like to say-“this isn’t the mainland” and by stating that we mean to say our economics are peculiar and sometimes detached from the other islands and the mainland itself.

Please find a few topics of interest to be aware of in 2018! Underlined topics are linked to more information and search results on my website-click often!

- The recent Tax Reform bill will also affect values and I believe the best article I found was one written by an economist at the National Association of REALTORS that has an interactive map for all States. They predict that Hawaii properties will increase on average 1.7% in 2018 which is a downward trend from the 6-7% we have experienced over the last 5-6 years. Not sure what effect the Tax Reform Bill will have on appreciation as a high percentage of purchases are cash sales in our resort markets and are not dependent on tax incentives relative to an interest deduction. Click here to view the article where you can select your State of interest for their prediction.

- The real estate market within the Kohala Coast resorts is varied in strength but all markets have risen since 2009 thus we are in the midst of one of the longest, slowest recoveries to go along with one of the longest, deepest recessions on our island.

- The new Kohanaiki resort is leading the way in development lot and condominium sales for the last 24 months. Resale Single family homes in the older communities within the established resorts like Mauna Kea and Mauna Lani lag behind in both appreciation and sales volume. Lastly, development lots within the resorts are still somewhat plentiful and relatively inexpensive as construction costs continue to rise having the affect of driving lot prices and demand down.

- Where is the sweet spot in the Kohala Coast and Kona market? It’s in resort condominiums below $1m and single family homes below $600k in locations like Waikoloa Village and Kona.

- Other than local buyers from Hawaii, where are buyers primary residences? Canada is the #1 international location and California from the USA in the Kona and South Kohala districts. Click Here to view the stats from Title Guaranty-2017 Hawaii Buyer Stats.

- These recent articles in the Pacific Business news offer a great synopsis:

By Janis L. Magin – Real Estate Editor, Pacific Business News – 1/3/18

Hawaii’s resort real estate market picked up steam in 2017, with overall sales volume increasing by 14 percent, compared to last year, and average prices increasing by 2.6 percent with resales of condominiums leading the growth, according to a resort residential market report by consultant Ricky Cassiday.

Cassiday sees the momentum continuing into 2018 and forecasts that sales and prices will accelerate due to global economic activity, the stabilization of China’s economy, low commodity prices and the effects of the U.S. tax cuts.

Cassiday told Pacific Business News that the data shows that the Hawaii resort market was starting to accelerate before Congress passed the tax package.

“This is a nice market, it’s starting to climb up the foothills,” he said. “Now with this, it will get more steam and take off.”

Overall sales in 2017 rose to 1,512 single-family homes, condos and homesites sold, with fourth-quarter numbers extrapolated from the year-to-date numbers from the first three quarters of this year.

That was a 13.9 percent increase from 1,328 sales in 2016. The average price rose 2.6 percent to $1.34 million, from $1.31 million in 2016.

The biggest driver of growth in 2017 was condo sales, and resales in particular, Cassiday found.

Condo sales in Hawaii increased by 16.2 percent to 1,011 units sold in 2017, compared to 870 units sold in 2016. The average price of those units rose by 7 percent to $1.06 million, from $989,362 in 2016.

Cassiday noted that there were fewer developer sales of resort condominiums in 2017, but resales made up for that decline with an increase of 25 percent to 944 units sold, from 755 units sold in 2016. The average price of those units rose by 10.6 percent to $975,918, from $882,440 in 2016.

Cassiday said it will be interesting to see how the tax cuts will affect sales of resort condos this year.

“It will be interesting how far down the price spectrum it expands,” he said. “If you’re a mid size company or even a small one, and you’re the owner, maybe you’ll buy a condo in Waikiki, maybe you’ll buy one in Ko Olina, or the North Shore.” ”

By Janis L. Magin – Real Estate Editor, Pacific Business News – 1/5/18

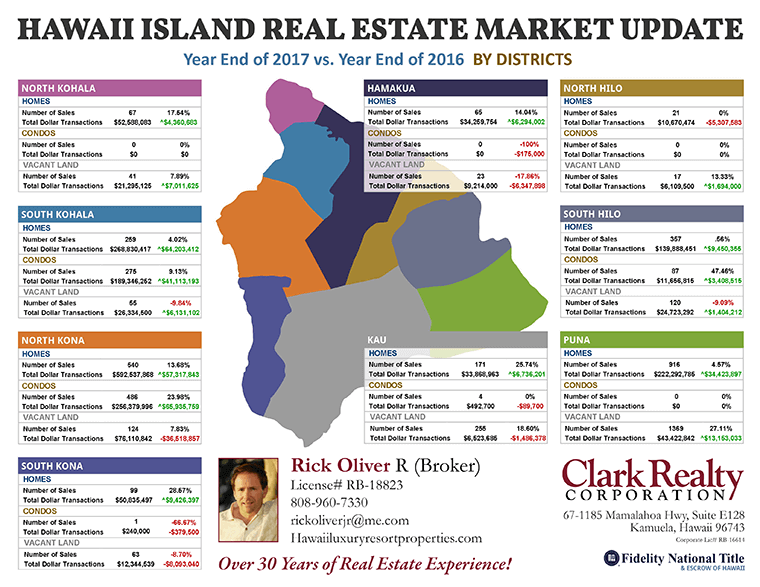

“Condominium sales on Hawaii’s Big Island rose 20 percent in 2017, compared to the year before, while sales of single-family homes there last year rose 8 percent and both categories saw modest price gains, according to statistics released by Hawaii Information Service on behalf of Hawaii Island Realtors.

The 853 condo units sold on the Big Island in 2017 was 19.97 percent more than the 711 units that sold in 2016. The median price of a Big Island condo in 2017 was $310,000, which was an increase of 1.64 percent from $305,000 in 2016.

Single-family home sales on the Big Island saw higher price gains in 2017 with a median price of $350,000, an increase of 6.06 percent from $330,000 in 2016. There were a total of 2,492 single-family homes sold in 2017, an increase of 8 percent from 2,307 homes sold in 2016.

For December, the median price of a single-family home on the Big Island jumped 19.12 percent to $339,500, from $285,000 in December 2016. But sales of single-family homes in December declined to 202 homes, which was 3.35 percent fewer than the 209 that sold in December 2016.

For Big Island condo sales, the 67 units sold in December represented a 13.56 percent increase from 59 sold in December 2016. But the median price of a condo declined by 2.37 percent in December to $288,000, from $295,000 in December 2016.” .

Rick’s Market Trends for 2018:

- Buyers are more likely to purchase a new or newer, high quality, existing home within the resorts as opposed to going through the 24-36 month planning and building process which often times generates a home that’s value is less than the total building and land costs. Check out my listing in 49 Black Sand Beach in the Mauna Lani Resort as one example. It’s 5200 square feet of luxury and is in an ocean front community with Honoka’ope Bay as its centerpiece amenity. We are building 3 new homes in my Nohea at Mauna Lani community priced at $2.79+. These homes can be provided at this value because the owner purchased the underlying land during the recession. These homes will be a great “move up” choice for some of the resort’s condominium owners, is pet friendly, allows vacation rental and has an incredible recreation center with exercise hale, salt water pool and spa and owner’s club house. These will be listed in the next several weeks and feel free to call me with your inquiries.

- New resorts in “up” markets will always out sell the older resorts and new developments within all resorts will outsell comparable older product. Positive markets bring buyers of all demographics into the marketplace providing a steady stream of “move up” buyers and or owners familiar with the current product offerings and also new buyers to our marketplace. More buyers produce higher prices with average inventory levels especially of condominiums and homes below $600k along the Kohala Coast resorts, Waikoloa Village, Waimea and the Kona marketplace.

- Price pressure is upward on resale properties due to the fact that little new inventory is available. The new inventory we have available was probably planned for development 5 years ago or longer and was finally started in the last few years or is a “re-start” development left over from the great recession and restarted in the last few years. Very few new developments within our resort market have been started from scratch in the last 3 years except these “re-start” efforts in Mauna Lani like Kulalani condominiums, KaMilo condominiums and Ke Kailani “building lot” sales for example. Prices within these communities are near or less than their prices in the 2006 peak making them relatively “inexpensive” especially with their prices adjusted for minimal inflation over the last 10 years. Check out my new listing in KaMilo with an incredible view of the golf course, its own pool/spa, Solar System with HELCO Net Metering agreement and sold with designer furnishings.

- A few rare exceptions of new developments within the Resort Markets:

- Lau’lea is a new development started from “scratch” in the last 24 months within Mauna Lani and features high quality finishes within their duplex town homes (2200 sf) and detached condominiums (2900 sf) that reflect higher construction and land costs. These units are or have been listed from $1.9m to $4.4m and MLS reflects several sales in this range. We are rooting them onward as they are achieving $1000+ per sf sales prices where others are only achieving half of this value per square foot for new and existing properties of similar quality! A rising tide raises all ships-hopefully sales at Lau’lea are a good sign for all new developments within the resort for their owners values.

- Re-start efforts in Mauna Kea include Wai’ula’ula where D.R. Horton purchased the remainder land and building slabs left over from Maryl Developments efforts ending in 2008-9. They down graded the interior/exterior features/finishes and were successful in selling a majority of the ocean view units for prices similar to the existing and upgraded resale units but still have several non ocean view units left to sell.

- Hapuna Estates is a new development within the Mauna Kea Resort offering building lots with ocean views. Prices start at ~$1m which would generate a total build cost of a 3500 SF home in excess of $3.5m-$4m+.

- There are a generous amount of new homes being built in the Kukio and Hualalai resorts where development lots were purchased at greatly reduced prices in the recession and their owners are finally building their dream homes plus a few speculative ventures by investor/builder groups.

- Let me now circle back to the Kohanaiki Resort that has led sales in the resort market for “built” product-mainly condominiums. Their sales have “slowed” as some of the new product does not have ocean views and the few remaining ocean view products are being absorbed. It will be interesting to see how they develop new, lessor priced product to account for the non ocean view to continue their sales streak.

Please contact me anytime where I can use my 17+ years of local resort knowledge and 30+ years of real estate experience in preparing a thorough review of your particular community or property. Like I mentioned, all “markets” are very particular and are affected by many factors! I look forward to your calls and emails!

Links to other very informative articles containing more stats!

- Corelogic Link to January 09, 2018-U.S. Economic Outlook: January 2018 New Home Sales Continue Steady Rise – Metro Areas in the South Led Nation in 2017 Sales

- National Association of REALTORS® 2018 Market Expectations

- National Association of REALTORS®-Metro Areas Most Affected by the New Tax Law

- REALTORS® Expect Nearly 3% Home Price Growth in the Next 12 Months